Waiver of Premium: How Do You Manage It?

When involving in system implementation (policy administration system) related work, I always encounter queries raised in administrating claim processes related to waiver of premium ("WOP") benefit. When WOP feature is triggered by a covered event (either death, TPD or critical illness), the benefit will be paid over long period (which may stretch for many years). This makes a systematic WOP claim process more important so that the inflow and outgo related to WOP benefit can be managed properly.

What is WOP benefit?

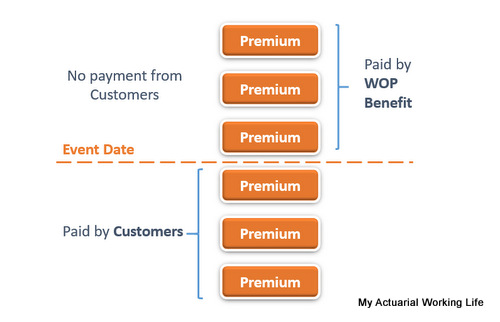

Briefly, when WOP feature is triggered by a covered event (either payor or insured), all future payments for premium after event date are "waived" - this doesn't mean the affected policy no longer receiving premiums. More accurately, although no payment is required for this policy, this policy still receives premiums - just the premiums come from different sources. This policy is expected to work as normal without any hiccup, for example, an investment-linked policy will continue to have allocated premiums to be invested in the unit funds as usual.

Yup, you have raised a very good question: "What do 'different sources' refer to?" Basically, when the WOP feature is triggered, risk fund shall "pay out" WOP claim. Different from other types of claims, the claim is not directly paid to the beneficiary - instead, the claim amount shall be used to: (depending on the company's preferred practice)

Method 1(a): Set aside as provision (no discounting)

There are variations for Method 1, i.e. "no discounting" & "with discounting" - method selection depends on product designs. Let's take a closer look on how the first one works using the following illustration:

Say a WOP rider (covers payor's death, TPD & critical illness) is attached to Policy A. It only covers for basic plan's premium, i.e. quarterly modal premium = 500. On a particular event date, let's say he policy still requires 22 quarterly premium payments after the event date.

In case some premium payments after the event date are already paid by the customer, an amount equal to total payments should be considered as "excess" that would need to be refunded to the customer.

Method 1(b): Set aside as provision (with discounting)

Basically, both variations of Method 1 work in the same way, with a few exceptions. Under this variation, instead of providing full future premium amount, a discounted amount (i.e. a present value, calculated using a specific discount rate) is set up as claim provision.

What is WOP benefit?

Briefly, when WOP feature is triggered by a covered event (either payor or insured), all future payments for premium after event date are "waived" - this doesn't mean the affected policy no longer receiving premiums. More accurately, although no payment is required for this policy, this policy still receives premiums - just the premiums come from different sources. This policy is expected to work as normal without any hiccup, for example, an investment-linked policy will continue to have allocated premiums to be invested in the unit funds as usual.

Yup, you have raised a very good question: "What do 'different sources' refer to?" Basically, when the WOP feature is triggered, risk fund shall "pay out" WOP claim. Different from other types of claims, the claim is not directly paid to the beneficiary - instead, the claim amount shall be used to: (depending on the company's preferred practice)

- Method 1: Set aside as provision (no change in reserves calculation)

- Method 2: Support huge increase in reserves (i.e. during reserve calculations, no future premium is assumed for policies with waiver status. When a policy changes from "normal paying" to "waiver", there is a huge increase in reserves due to zerorization of future premiums)

Method 1(a): Set aside as provision (no discounting)

There are variations for Method 1, i.e. "no discounting" & "with discounting" - method selection depends on product designs. Let's take a closer look on how the first one works using the following illustration:

Say a WOP rider (covers payor's death, TPD & critical illness) is attached to Policy A. It only covers for basic plan's premium, i.e. quarterly modal premium = 500. On a particular event date, let's say he policy still requires 22 quarterly premium payments after the event date.

- When WOP claim is approved, risk fund provides a claim provision amounted 11,000 (= 22 x 500) (e.g. provision for outstanding claims).

- When the quarterly premium is due, 500 is taken from the provision (as settled claim) and serves a premium payment.

- If Policy A is terminated before its maturity date (e.g. surrender), the provision that is not utilized is released back to risk fund.

In case some premium payments after the event date are already paid by the customer, an amount equal to total payments should be considered as "excess" that would need to be refunded to the customer.

Method 1(b): Set aside as provision (with discounting)

Basically, both variations of Method 1 work in the same way, with a few exceptions. Under this variation, instead of providing full future premium amount, a discounted amount (i.e. a present value, calculated using a specific discount rate) is set up as claim provision.

The tricky part of using Method 1(b) is the claim provision needs to be adjusted from time to time to reflect investment element - by using the same discounting rate. This investment element may introduce additional risk to the company, i.e. the actual investment yield may be lower than the discount rate - as the provision needs to be adjusted at fixed rates (otherwise it will be insufficient), in the event of shortfall, it needs to be supported by other sources. Additional capital may be required for uncertainty in investment element.

Method 2: Support huge increase in reserves

Method 2 is similar to Method 1(b) - instead of setting up separate claim provision for waiver policies, all future premiums are zerorized when calculating actuarial reserves, which yields a huge increase in reserves. The company may want to quantify portion of increase in reserves attributable to zerorization of future premiums as WOP claim.

When a premium is due, a portion of reserves will be released for premium payment:

Furthermore, the company may require additional capitals due to larger reserves - Method 2 involves more uncertainty comparing to Method 1(b) because reserve calculation uses assumptions in decrements (e.g. death, TPD, critical illness & surrender).

Last but Not Least: COI / tabarru' for WOP Rider

I always face headache when working on WOP rider, as it involves very large tables - too large until it is impossible for me to examine the rates carefully. Large tables are acceptable for premium rates (as level premiums are charged for WOP rider), however it is unacceptable for COI (Cost of Insurance) for conventional investment-linked products or tabarru' for family takaful products (both ordinary family with participant account & investment-linked). Why?

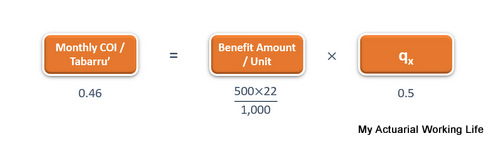

As discussed earlier, when a WOP claim is approved (under Method 1), a specific claim amount is paid out from risk fund. Consistently, the COI / tabarru' should be calculated on the benefit amount expected to be paid out from risk fund upon claim.

By using the example discussed earlier, the COI / tabarru' should be calculated as:

Method 2 is similar to Method 1(b) - instead of setting up separate claim provision for waiver policies, all future premiums are zerorized when calculating actuarial reserves, which yields a huge increase in reserves. The company may want to quantify portion of increase in reserves attributable to zerorization of future premiums as WOP claim.

When a premium is due, a portion of reserves will be released for premium payment:

- For a large portfolio, the release in reserves should be more than amount to be utilized as premium payments, due to prudent assumptions in reserve calculations.

- However, mismatch may occur for small portfolio, i.e. the release in reserve is insufficient to support premium payments (as variance is larger for small portfolio).

Furthermore, the company may require additional capitals due to larger reserves - Method 2 involves more uncertainty comparing to Method 1(b) because reserve calculation uses assumptions in decrements (e.g. death, TPD, critical illness & surrender).

Last but Not Least: COI / tabarru' for WOP Rider

I always face headache when working on WOP rider, as it involves very large tables - too large until it is impossible for me to examine the rates carefully. Large tables are acceptable for premium rates (as level premiums are charged for WOP rider), however it is unacceptable for COI (Cost of Insurance) for conventional investment-linked products or tabarru' for family takaful products (both ordinary family with participant account & investment-linked). Why?

As discussed earlier, when a WOP claim is approved (under Method 1), a specific claim amount is paid out from risk fund. Consistently, the COI / tabarru' should be calculated on the benefit amount expected to be paid out from risk fund upon claim.

By using the example discussed earlier, the COI / tabarru' should be calculated as:

- Benefit amount: 500 x 22 = 11,000.00

- COI / tabarru' rate (qx): 0.5 per 1,000 (varying by gender & attained age)

- Monthly COI / tabarru' = 11,000 / 1,000 x 0.5 x 12 = 0.46

Good article!! I have a question. Do the insurer charge a premium to the insured for WOP benefit?

ReplyDeleteI'm terribly sorry that I only find out your comment here. Thanks for going through my article.

DeleteFor your questions, the answer is both "Yes" and "No" - depending on product designs:

- The benefit may be provided as a rider. For investment-linked products, no premium is required if the rider is a unit deducting rider (i.e. only deduct for COI).

- The benefit may be included as part of the product features, i.e. no premium is required if the insured is diagnosed with (say) critical illness. Although no extra premium is required, the WOP is taken into consideration when setting the premium rates.

Good article!! A quick follow up to your response above. How do you consider the WOP when setting the premium rates?

ReplyDeleteSorry that I have overlooked your comment earlier. In term of setting the premium rates, it has to be consistent to how the benefit outgo will be when a benefit is triggered. Of course the rates will be lower if the benefit outgo is a form of PVs.

DeleteNormally, the premium rates vary by remaining term and entry age.