Back to Basic - Movement of Policy (MOP)

If you ask me what a fresh graduate should learn first when he joins your actuarial department, I will definitely answer he needs to learn movement of policy (MOP).

In my view, MOP is the basic of all actuarial studies - it is about how a policy " behaves" during the entire life cycle, i.e. from when the policy is set in force until the policy is terminated (including maturity / expiry). By having a good understanding in MOP, it will be easier for us to visualize the relevant cash flows occur during policy term - especially when we setup an actuarial model to project cash flow. When I setup the Takaful Library for my client, the "base" variables I setup first are MOP related variables.

From what I learn from friends in the industry, many companies are struggling to get the "correct" MOP statistics - which are known as L6, L7 & L8 for conventional insurers and FT5, FT6 & FT7 for takaful operators (namely "New Business", "Termination/Alteration" & "In Force Business" respectively). These statistics are the most widely used statistics (especially in measuring industry performance & competitor analysis), unfortunately they are normally done by junior staffs without adequate guidance from their seniors (perhaps used to be the seniors' nightmare previously) to improve/correct the MOP statistics.

Well, in case you are looking for some info on how to preparing these statistics, I hope the summarized write-up below can provide you some insights. For the purpose of reporting, normally we will compile statistics on no. of policies, sum assured and annualized premium.

In my view, MOP is the basic of all actuarial studies - it is about how a policy " behaves" during the entire life cycle, i.e. from when the policy is set in force until the policy is terminated (including maturity / expiry). By having a good understanding in MOP, it will be easier for us to visualize the relevant cash flows occur during policy term - especially when we setup an actuarial model to project cash flow. When I setup the Takaful Library for my client, the "base" variables I setup first are MOP related variables.

From what I learn from friends in the industry, many companies are struggling to get the "correct" MOP statistics - which are known as L6, L7 & L8 for conventional insurers and FT5, FT6 & FT7 for takaful operators (namely "New Business", "Termination/Alteration" & "In Force Business" respectively). These statistics are the most widely used statistics (especially in measuring industry performance & competitor analysis), unfortunately they are normally done by junior staffs without adequate guidance from their seniors (perhaps used to be the seniors' nightmare previously) to improve/correct the MOP statistics.

Well, in case you are looking for some info on how to preparing these statistics, I hope the summarized write-up below can provide you some insights. For the purpose of reporting, normally we will compile statistics on no. of policies, sum assured and annualized premium.

- New Business (L6/FT5) - all new policies issued during the current reporting month. You should refer to the issue date of the policy instead of effective date / risk commencement date. By right, issue date should be the date when a proposal is converted to in force status.

- Termination / alteration (L7/FT6) - all policies terminated & reinstated during the current reporting month, or the changes (i.e. alterations) done on the in force policies.

Types of terminations are (1) maturity/expiry, (2) lapse (due to non-payment of premium / exhaustion of funds), (3) surrender (voluntarily withdrawal), (4) free look cancellation, (5) cancellation due to other reasons such as non-disclosure or administrative errors, (6) claim (that terminates policy, such as death, accelerated total & permanent disability (TPD) and accelerated critical illness (CI)).

Alterations refers to (1) reinstatement, (2) the changes done on sum assured amount and premium amount to the in force certificates, (3) addition/termination of riders.

- In Force Business (L8/FT7) - the in force policies which are considered as in force as at end of the month. You may find out the "in force" policies may have various policy statuses, such as "In Force (normal premium paying)", "In Force (premium waived)" and "Paid-up", "Reduced Paid-up (RPU)" and "Extended Term Insurance (ETI)".

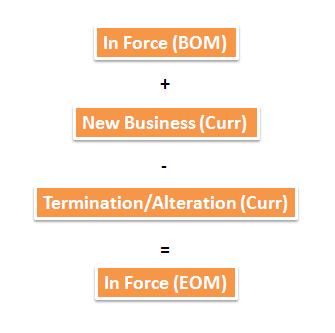

- NOP at beginning of current month (also NOP at end of previous month)

- Add: New business acquired during current month

- Minus: "Net" Terminations occur during current month (Termination NOP - Reinstatement NOP)

- Equal to NOP at end of current month

Comments

Post a Comment