Waiver of Premium: How Do You Manage It?

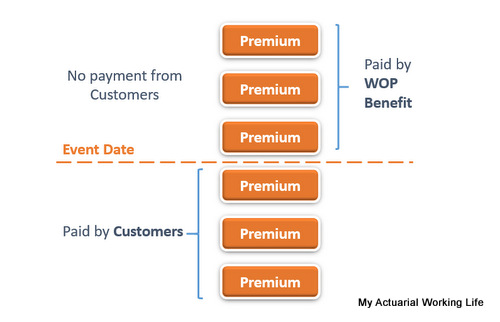

When involving in system implementation (policy administration system) related work, I always encounter queries raised in administrating claim processes related to waiver of premium ("WOP") benefit. When WOP feature is triggered by a covered event (either death, TPD or critical illness), the benefit will be paid over long period (which may stretch for many years). This makes a systematic WOP claim process more important so that the inflow and outgo related to WOP benefit can be managed properly. What is WOP benefit? Briefly, when WOP feature is triggered by a covered event (either payor or insured), all future payments for premium after event date are "waived" - this doesn't mean the affected policy no longer receiving premiums. More accurately, although no payment is required for this policy, this policy still receives premiums - just the premiums come from different sources. This policy is expected to work as normal without any hiccup, for example, an inves...