Back to Basic - Movement of Policy (MOP)

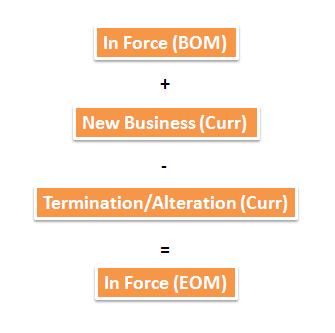

If you ask me what a fresh graduate should learn first when he joins your actuarial department, I will definitely answer he needs to learn movement of policy (MOP). In my view, MOP is the basic of all actuarial studies - it is about how a policy " behaves" during the entire life cycle, i.e. from when the policy is set in force until the policy is terminated (including maturity / expiry). By having a good understanding in MOP, it will be easier for us to visualize the relevant cash flows occur during policy term - especially when we setup an actuarial model to project cash flow. When I setup the Takaful Library for my client, the "base" variables I setup first are MOP related variables. From what I learn from friends in the industry, many companies are struggling to get the " correct " MOP statistics - which are known as L6, L7 & L8 for conventional insurers and FT5, FT6 & FT7 for takaful operators (namely "New Business", "Termi...